What Caused the Plunge in Commodity Prices?

Advertisements

In the intricate world of financial markets, where political maneuvering and economic policies intertwine, fluctuations in exchange rates become a common phenomenon. The volatility in currency value often reflects deeper tensions and uncertainties in global affairs.

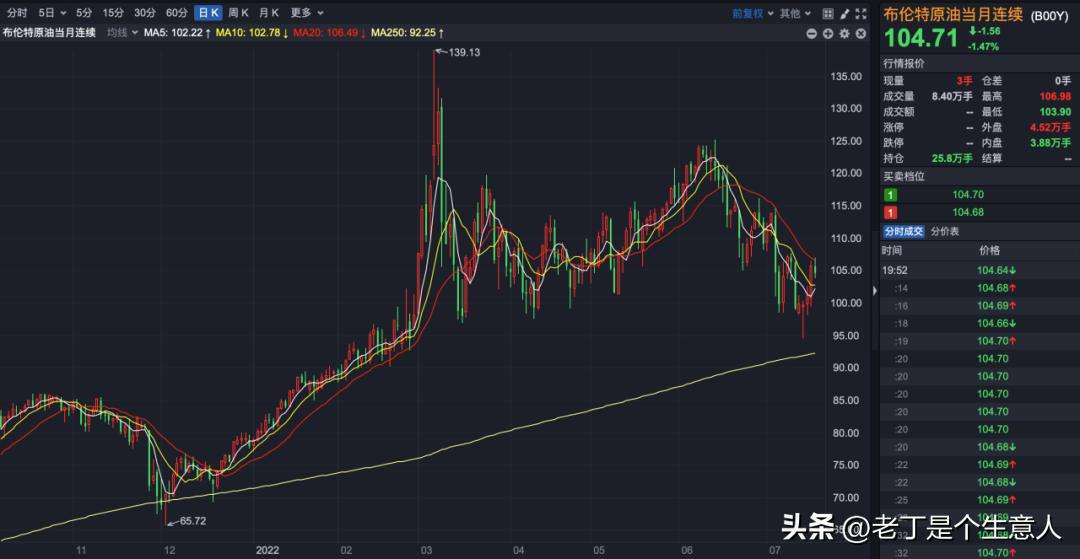

Looking back at the first half of this year, the impact of rising commodity prices was palpable. The noticeable increase in international oil prices has significantly affected gasoline prices in China, resulting in a consecutive series of price hikes for nine weeks. Such rapid increases affect not only businesses but also the everyday lives of ordinary citizens, echoing the interconnectedness of global economies.

Moreover, we have witnessed an ongoing increase in China's Producer Price Index (PPI) over the last year, indicating rising manufacturing costs. This rise is not isolated to China; globally, soaring raw material costs have led to a sharp increase in consumer prices, challenging households to manage their budgets amidst climbing expenses.

As we saw a consistent rise in commodity prices, a startling shift occurred recently, characterized by a swift decline in prices for various raw materials, including coal, crude oil, steel, and cotton. Investment in fuel futures in China has even seen drastic sell-offs as prices approached their limit down transition.

Previously, the rise in global prices, coupled with monetary tightening, stock market declines, and instances of national bankruptcies, correlated with the escalation of commodity prices. Now, as we transition to a phase of declining commodity prices, we ponder the implications of such a trend. What will the future hold for commodity prices? How will these changes reverberate through the global economy?

The recent decline in commodity prices primarily stems from investors' concerns regarding a potential economic recession. With significant increases in interest rates, the risk of transitioning from stagflation to recession looms large. A downturn in consumption leads to reduced demand, which in turn sees production cuts. Consequently, this results in a diminished need for raw materials, impacting commodities directly.

It’s important to note that this decline differs from previous instances. Whereas past commodity price fluctuations saw synchronized movements across major economies, the current scenario reveals interesting contrasts. Countries like China and Russia are experiencing a phase of macroeconomic bottoming, where policies are gradually loosening and confidence is beginning to establish a foothold. Conversely, many economies overseas are grappling with a nearing peak of stagflation coupled with tightening policy measures, leading to heightened anxiety among investors.

This divergence underscores the need to analyze important commodities separately. For example, in the case of pork, supply and demand dynamics are largely dictated by the "pig cycle." Conclusively, based on our analysis from September of last year, we predicted that the fourth quarter would mark the bottom of the current pig cycle. The capital market typically reflects such changes about six months in advance, which accounts for the recent surge in pork futures in July, followed by a swift retract.

Investor speculation played a role in this volatility, leaving forward contract prices hovering around 20,000. Moving forward, we expect to see price stagnation, with a possible uptick in pork prices as the cycle progresses further into the fourth quarter.

Additionally, we must consider commodities such as natural gas, coal, palm oil, and crude oil that are not only driven by domestic demand but are also heavily influenced by international prices. The foremost among these, crude oil, has experienced a notably steep decline.

Globally, most commodities are denominated in USD. The current trend of rapid dollar appreciation, in which the dollar index remains firmly around 100, has suppressed demand for these commodities. For instance, the euro to dollar exchange rate recently neared parity at 1:1. Subsequently, when the euro depreciates while oil prices rise, EU countries face a higher cost burden when purchasing oil.

Consequently, the primary drivers affecting crude oil, steel, and coal prices are the prospects of impending economic recession and the strengthening dollar. Presently, the fundamental supply-demand dynamics have not dramatically altered. Notably, over the last four decades, the dollar index has consistently maintained a relatively high position. Historical trends suggest limited upward movement for the dollar going forward.

The current dip in commodity prices could mitigate the sustained inflation witnessed globally, potentially easing the Federal Reserve's monetary tightening policies. This, in turn, would alleviate the prevailing apprehensions surrounding "future economic recession."

Looking ahead, we can anticipate that steel, crude oil, coal, and other major commodity prices will likely trade sideways at current levels, with intermittent fluctuations. It seems improbable for prices to suddenly decline sharply.

Another critical commodity is gold, typically inversely correlated with the dollar index. Historically, gold tends to decline as the dollar appreciates; simultaneous increases or decreases are rare.

From this perspective, if the dollar's rapid appreciation stabilizes, gold price declines may also find their limit. Furthermore, our predictions regarding future commodity trends contribute to varied impacts on investors and economies alike.

To summarize our key insights: the recent decline in commodity prices has been primarily driven by rapid interest rate increases in numerous regions, prompting market sentiments regarding an impending recession. This anticipated recession leads to reduced demand for commodities, creating downward pressure on prices.

Different commodities will exhibit varying trends due to different global supply-demand conditions. For instance, pork prices are significantly influenced by the Chinese pig cycle, thus likely showing a price rise beginning from the fourth quarter onward.

Contrarily, commodities such as crude oil, palm oil, coal, and natural gas will primarily respond to international supply-demand shifts. Expectations about the economy and currency exchange rates, coupled with current supply-demand situations, suggest that prices will stabilize at moderate levels, discouraging excessive speculation.

For precious metals like gold and silver, recent declines have largely been driven by a strengthening dollar, indicating that gold may have reached its bottom and could rebound. As of the time of writing, the date marks July 23, 2022.

What remains to be seen is the broader impact of these commodity price declines.

When commodity prices begin to drop from their peaks, we've already noticed the end of China's nine consecutive gasoline price increases, with initial signs of decreased prices also emerging.

However, the repercussions of reduced prices for crude oil, coal, and steel extend beyond mere price adjustments. More crucially, these trends signal a rethinking of global inflation expectations, transitioning from severe inflationary conditions toward a potential retreat in inflation. This shift could induce changes in global monetary policies; central banks that previously anticipated sharp rate hikes may now forecast more moderate increases.

Such changes in expectation prompt early reactions in the capital markets; for example, in July, there was notable recovery in U.S. indices, with the Nasdaq rebounding 8% within the month.

As commodity prices soften, regions heavily reliant on imports—such as the European Union, China, and Japan—could benefit from reduced inflationary pressures and trade deficits. Should commodity prices maintain this downward trajectory or even further decline, it would facilitate trade balances and relieve economic pressures in various nations.

Overall, the recent declines in commodity prices are likely to benefit China more than harm it.

This year has shown unprecedented levels in numerous metrics across the globe. For instance, inflation rates in many countries have reached a 40-year high, while commodity prices have surged to levels not seen in years. This confluence of severe economic downturns is indeed a rare phenomenon. The Federal Reserve's aggressive rate hikes are reminiscent of historical financial tightening episodes, while many nations face record debt levels and political anomalies.

Given the current peculiar environment, many of these issues still persist without resolution. Throughout the year, we have maintained consistent investment strategies, reinforcing our positions from earlier in the year in anticipation of market developments.

That said, we conclude our exploration here for this segment.

Recent post

- Impact of Interest Rate Inversion on A-Shares

- What Caused the Plunge in Commodity Prices?

- U.S. Stocks Rise Over 1% Across the Board

- Impact of Significant US Dollar Appreciation

- Negative Surge: Collective Plunge!

- Inflation in the U.S. is Declining

- AI Hardware to Dominate Consumer Electronics in 2025

- UK Markets Hit by Broad Sell-Off

- AI in Pharma: Accelerating Medical Innovation

- Tech Bull Run in US Stocks Continues